SAGE. 50 - CH. 2 REVIEW ACTUAL 2025/2026 LATEST UPDATE

Course:

SAGE

Institution:

SAGE

SAGE. 50 - CH. 2 REVIEW ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS The Goods and Services Tax or GST is applied - A) to all goods and services sold in Canada B) only to merchandise sold in Canada C) to all goods and services except food and ...

After purchase, you get:

✅ Instant PDF Download

✅ Verified answer explanations

✅ Refund if not Satisfied

✅ Prepared for 2025/2026 test cycle

Overview

Learners gain valuable practice with question types commonly used on official SAGE. 50 - CH. 2 REVIEW ACTUAL / UPDATE exams. From multiple-choice to case studies, you'll encounter the full range of formats used in actual assessments. This complete exposure prevents surprises on test day and builds adaptability in your approach. Students often mention how this variety keeps their study sessions interesting and engaging over weeks of preparation.

Who Is This For?

Effective for learners who prefer to study through real exam simulations rather than broad, unfocused summaries. This practical approach resonates with hands-on learners. The realistic practice helps build both knowledge and assurance.

Related Keywords

Detailed Study Description

Frequently Asked Questions

Document Information

| Uploaded on: | October 31, 2025 |

| Last updated: | November 17, 2025 |

| Number of pages: | 10 |

| Written in: | 2025/2026 |

| Type: | Exam (elaborations) |

| Contains: | Questions & Answers |

| Tags: | SAGE. 50 - CH. 2 REVIEW ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS The Goods and Services Tax or GST is applied - A) to all goods and services sold in Canada B) only to merchandise sold in Canada C) to all goods and services except food and medicine D) to most goods and services sold in Canada - Answer -D) to most goods and services sold in Canada |

Seller Information

AdelineJean

User Reviews (0)

Exam (Elaborations)

$8.00

Bundle Deal! Get all 9 docs for just $26.00

Add to Cart

100% satisfaction guarantee

Refund Upon dissatisfaction

Immediately available after purchase

Available in Both online and PDF

$8.00

| 0 sold

Discover More resources

Available in a Bundle

Inside The Document

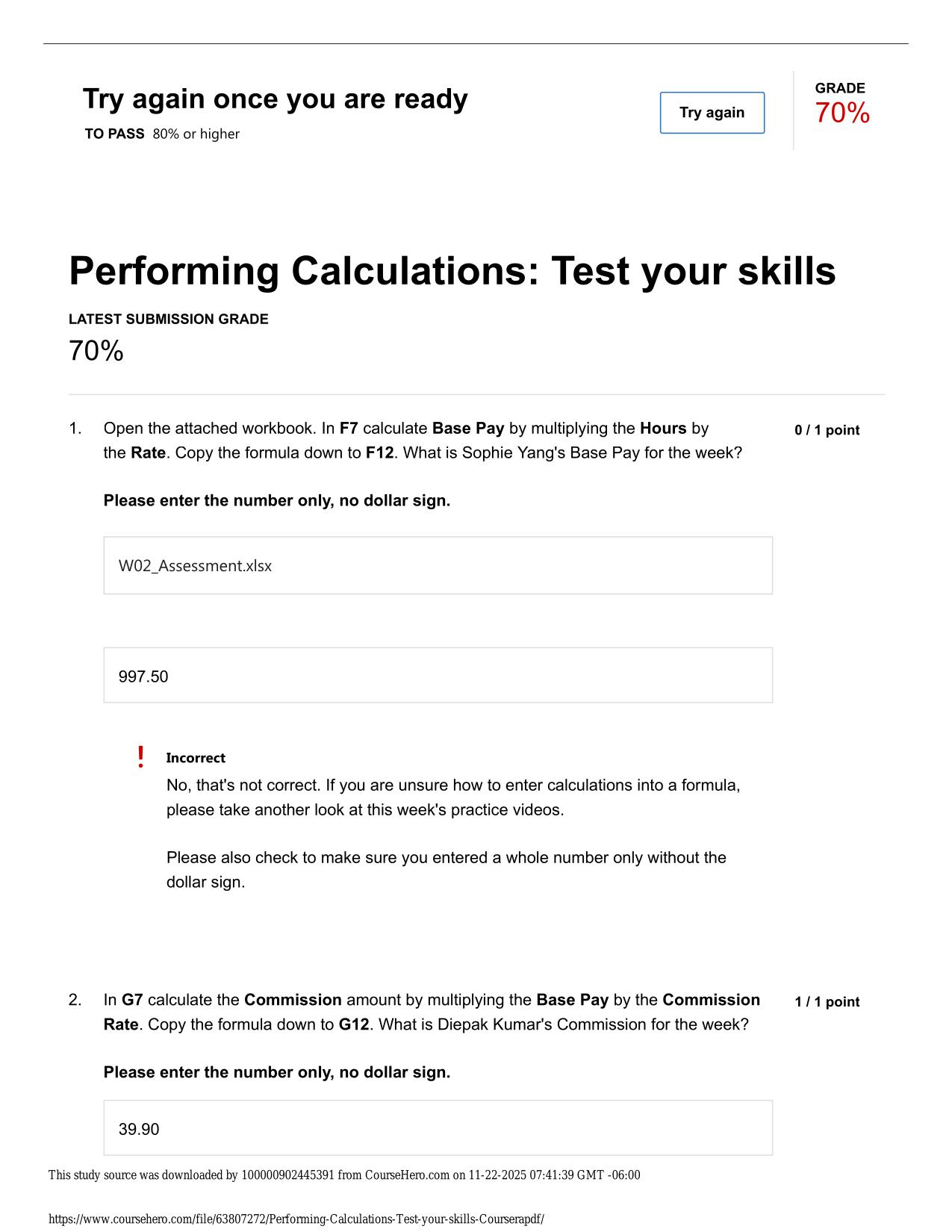

SAGE. 50 - CH. 2 REVIEW ACTUAL 2025/2026 QUESTIONS AND 100% CORRECT ANSWERS The Goods and Services Tax or GST is applied - A) to all goods and services sold in Canada B) only to merchandise sold in Canada C) to all goods and services except food and medicine D) to most goods and services sold in Canada - Answer -D) to most goods and services sold in Canada Businesses must register for GST and apply GST to sales if - A) they sell to customers in Canada B) they have annual sales over $30 000 C) they import goods from outside of Canada D) all businesses in Canada must register for GST - Answer -B) they have annual sales over $30 000 Registration for GST favours a business because - A) it increases revenue as customers pay more for the products and services B) it makes the tax reports easier to prepare C) it allows a business credits for the GST it pays for business-related expenses D) there are no advantages to registering for GST - Answer -C) it allows a business credits for the GST it pays for businessrelated expenses Items that are not taxable for GST - A) are mostly basic necessities Need assistance on Online classes, Exams & Assignments? Reach out for instant help!! Full Course Assistance, Plagiarism-free Essay Writing, Research Paper, Dissertation, Discussion Posts, etc…. Confidential & Secure services. Tutors are available for all subjects! Email now at: tutorjean01@gmail.com

CourseHero & Studypool Unlocks

Get Unlocked CourseHero and Studypool documents files instantly to your email, simply by pasting your link and clicking "Unlock Now". Learn more on how to unlock here.